52+ why isn't my mortgage interest deductible this year

Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. Look in your mailbox for Form 1098.

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

In that case the tax deduction should not affect.

. Web As Wall Street reels from the swift demise of Silicon Valley Bank the biggest American bank failure since the 2008 financial meltdown some social media. Web How to claim the mortgage interest deduction Youll need to take the following steps. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Web The mortgage interest deduction got a new limit One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage. Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. Your mortgage lender sends you.

Now the loan limit is 750000. Both of you should attach. Web You can deduct all of your mortgage interest on up to 1 million in principal on the home in which you live.

16 2017 then its tax-deductible on. Used to buy build or improve your main or second home and Secured by that home. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Up to 96 cash back A home mortgage is also called acquisition debt these are debts that are. You can revisit your entries to confirm for example that. Web There are a number of reasons you might not be seeing mortgage interest on Schedule A after entering it.

Web However unless you itemize deductions you cant claim the home mortgage interest deduction anyway. Web The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

Thus if you pay interest on a 250000 mortgage all of. That means for the 2022 tax year married.

Rocky Point Times March 2022 By Rocky Point Services Issuu

Understanding The Mortgage Interest Deduction With Taxslayer

Understanding The Mortgage Interest Deduction With Taxslayer

German Reading Skills For Academic Purposes 0367186624 9780367186623 Dokumen Pub

Hmw Conference Proceedings 2013 By Te Kotahi Research Institute Issuu

Understanding The Mortgage Interest Deduction With Taxslayer

Adjustments Matter Mauldin Economics

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Benjamin Graham Articles Magazine Of Wall Street 1917 1922 Pdf Bonds Finance Yield Finance

No More Mortgage Deduction

Rocky Point Times July 2022 By Rocky Point Services Issuu

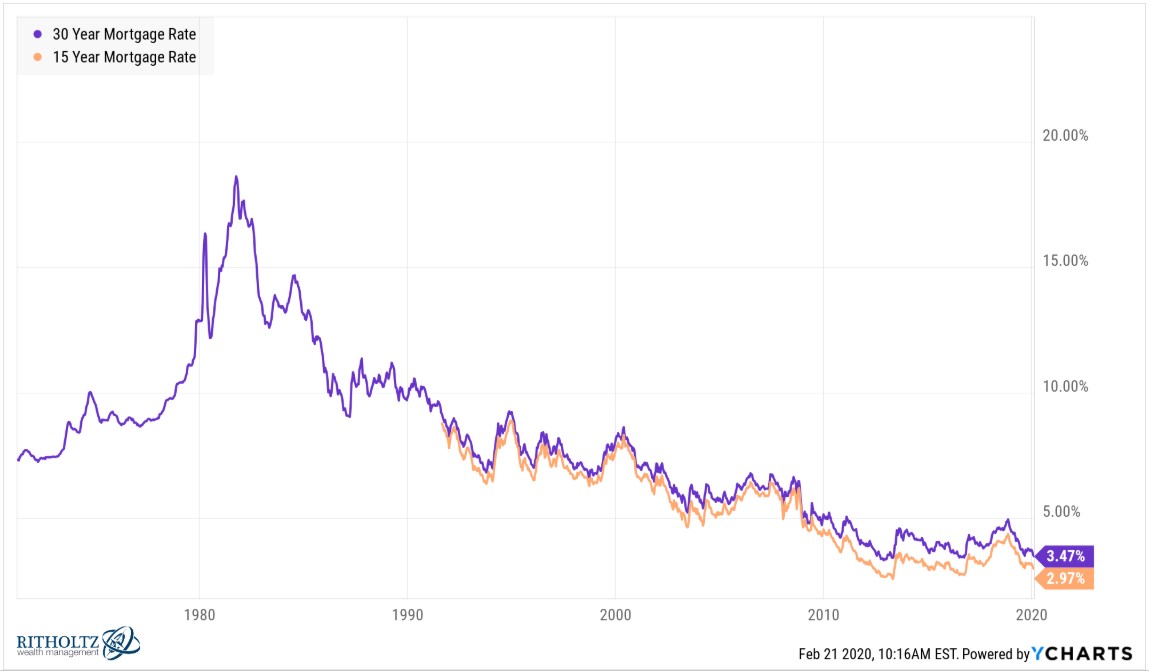

Should You Pay Off Your Mortgage Early With Rates So Low

Personal Finances Are Personal For A Reason And Again Shoutou Tiktok

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

The Villager Ellicottville December 23 30 2015 Volume 10 Issue 52 By Jeanine Zimmer Issuu

Chart Of The Day Focus On The Easy Money Smart Money Tracker

Tax Tips For Photographers To Maximize Your Take Home The Photo Argus